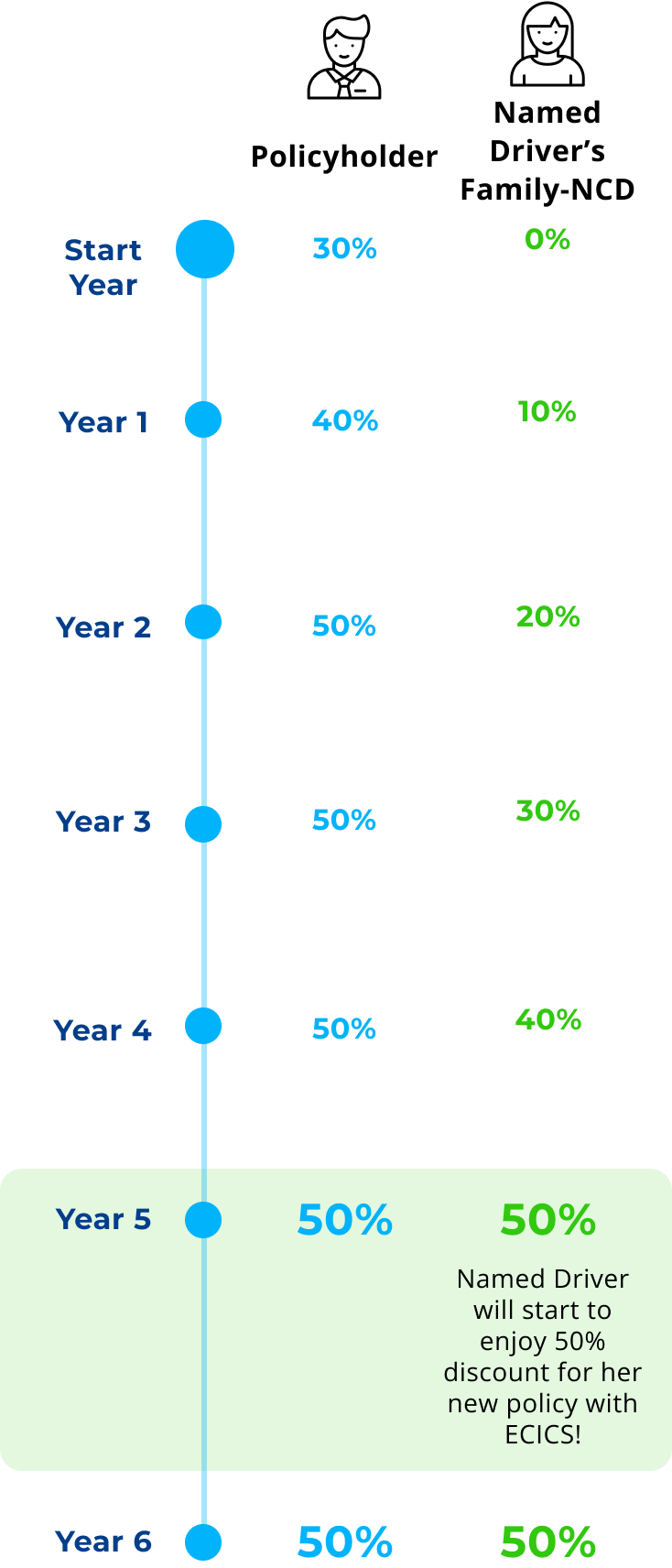

Every named driver earn 10% Family-NCD (up to 50%) for each year of safe driving as a family without any accidents - even if they don't own a car.

When your family member buys their own car, their accumulated Family-NCD can be used to reduce their insurance premium with ECICS.

Includes personal accident coverage up to $80,000 for your family members, child seat protection up to $300, and car key replacement cover up to $300.

Get 24/7 roadside assistance, and up to 10 days courtesy car while your vehicle is being repaired.

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

Contact us at +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm) or write to us at customerservice@ecics.com.sg.

The premium is determined by the plan you choose, not by your age.

Yes, for help with account issues, please contact the Charge+ team directly as they manage the platform. Their contact details and your enquiry can be submitted here: https://www.chargeplus.com/about

The deductible is the amount payable by you for each and every claim made against the policy.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

Refund Policy (Upon Policy Termination):0 to 30 days in force – 80% refund of premium31 to 90 days in force – 50% refund of premium91 to 180 days in force – 30% refund of premium181 days and beyond – No refund100% of the premium will be refunded if:a) The Policy is cancelled within 90 days from the policy effective date and replaced with a new ECICS Enhanced MaidAssure policy; orb) The In-Principal Approval (IPA) is terminated and the FDW did not enter Singapore.Provided there shall be no refund if: • Any claim has been made or has arisen under the Policy; or • The premium refund is less than $27.25 (inclusive of GST). Please refer to General Conditions point 19 of the policy wording for the full cancellation terms and conditions.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

A Security Bond is a commitment to reimburse the government if either you or your FDW violates or fail to adhere to the terms and conditions of the work permit. This bond typically takes the form of a banker's or insurer's guarantee. For each FDW you employ (excluding Malaysian helpers), you are required to purchase a $5,000 security bond.

You will need to cancel her work permit to stop your levy and ensure that you keep a copy of her travel ticket or departure itinerary as proof. MOM will proceed to discharge the Security Bond after verifying that your FDW has left and did not re-enter Singapore. Upon discharge, you may proceed to request for policy cancellation.

No, you do not need to pay $5,000 upfront to MOM as we act as a guarantor by issuing a Letter of Guarantee to MOM on your behalf. However, if you or your FDW breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. In such cases, we will seek recovery of the amount from you.

All riders need to be named in the policy. Unnamed riders are not covered.

Yes, we offer complimentary excess waiver of up to $750 (depending on your current NCD%) for the first claim in a policy year when you repair your accident car at ECICS’s authorized workshops and share your in-car cctv footage with us.

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.

You should remember to take note on the following (if the traffic condition permits):Take photos and videos of the accident scene, surrounding areas, damaged property and the damages of the vehicles involved together with their license plate numbers.Exchange particulars with all drivers involved in the accident.Actual road name and any prominent landmarks.If possible, take down the particulars of all injured persons and note the extent of the injuries sustained.

If your policy covers Unnamed Drivers, there are additional excess(es) for Unnamed Drivers and Unnamed Young or Inexperienced Drivers. Such additional excess(es) will be applicable on top of the standard policy excess. Please refer to your policy wording for more information.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.