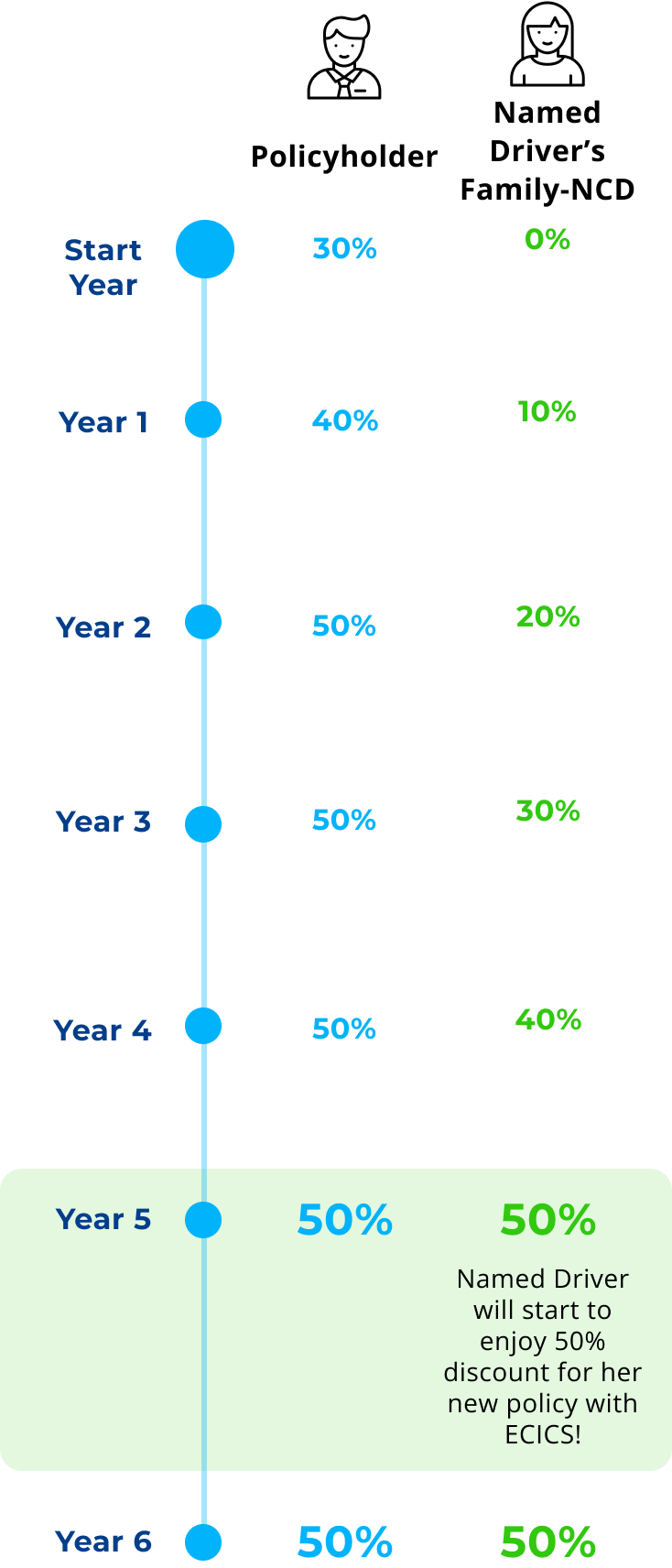

Every named driver earn 10% Family-NCD (up to 50%) for each year of safe driving as a family without any accidents - even if they don't own a car.

When your family member buys their own car, their accumulated Family-NCD can be used to reduce their insurance premium with ECICS.

Includes personal accident coverage up to $80,000 for your family members, child seat protection up to $300, and car key replacement cover up to $300.

Get 24/7 roadside assistance, and up to 10 days courtesy car while your vehicle is being repaired.

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

No, all earned Family-NCD remains intact so long as the policy is in-force. Each Family NCD member can only utilize their Family-NCD once with us and is not transferrable.

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

Climbing, mountaineering, racing or motor rallies, speed testing, speed contest, underwater activities involving the use of underwater breathing apparatus (including but not limited to diving), martial arts, parachuting and other extreme sports which involve one of the following elements of speed, height, a high level of physical exertion or specialized gear are not covered.

It is not transferrable to other insurers. This is a unique and innovative feature of our product to provide customers and their loved ones the best value they can get.

Certain amendments (e.g., typo error in name or passport number or change in effective date) can be made before the policy effective date. However, a re-transmission to MOM may be required depending on the type of amendment.

The coverage period for our Enhanced MaidAssure is 14 months or 26 months with the additional 2 months included as mandated by the Ministry of Manpower (MOM) in case the FDW overstays in Singapore after her work permit expires.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

• Outpatient Medical Expenses (For Accident) cover medical bills for outpatient treatments that arise solely from Accident. For example, your FDW accidentally scalds her hand while cooking and requires dressing for the burn.• Hospital & Surgical Expenses cover inpatient medical bills for treatments related to both accidents and illnesses.

MOM will issue the discharge letter 1 week after the FDW has left Singapore. Please provide us with a copy of the discharge letter to proceed with your cancellation.Please note that the effective date of insurance cancellation will be determined based on the discharge date from MOM, not the date when the work permit is cancelled.

Yes, we offer it as an optional add-on that covers outpatient medical expenses for illness that does not require hospitalisation. This benefit can cover up to $60 per visit, helping to ensure your FDW’s health needs are taken care of without added financial strain.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

All earned Family-NCD will be reduced according to the GIA NCD framework (https://gia.org.sg/). However, with the Family NCD benefit still in place, it means all the Family NCD members can continue to earn 10% with each year of safe driving (max at 50%).

A No Claim Discount Protector protects your NCD on renewal and allows you to make a claim under your policy without affecting your NCD. Without it, your NCD will be reduced should a claim be made under your policy.

Excess, also known as the deductible, is the first amount of the claim that the policyholder needs to bear in view of the claim.

Please declare all claims (excluding windscreen claims) made against your private car insurance during the past 3 years.

It is advisable to make a claim on your own insurance policy. Making a claim against motorists from another country can turn out to be costly and time-consuming. If you are not at fault, your NCD will not be affected.