Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

You may purchase Tesla Motor Insurance policy directly through our ECICS website >https://www.ecics.com/promotions/tesla-promotion

In principle, your NCD applies to you and not to your vehicle. For example, if you sell your vehicle and buy another one, you will retain your NCD. However, if you own more than one vehicle, you might have a different NCD for each vehicle. You should check the details with your insurer, but generally: Your NCD can- - Be transferred if you decide to switch insurer. - Be transferred to another vehicle you own, but it cannot be applied to more than one vehicle at any point in time. For example, if you have accumulated a 30% NCD while using one vehicle, it does not follow that the same NCD applies to any other vehicle that you own or decide to buy. In other words, you will have to earn the NCD for each vehicle separately Your NCD cannot- - be transferred to another person, except for your spouse and within the current insurer only. Transfer of NCD to your spouse will not be applicable if you renew your policy with another insurer.

No, there are no administrative or processing fees associated with claiming your Tesla Fractional Shares.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Public Liability insurance indemnifies your business against: 1) All sums you are legally liable to pay for compensation in respect of: - accidental bodily injury to any person; and/or - accidental loss of or damage to property belonging to third parties within the territorial limits during the period of indemnity and happening or caused in connection with your business. 2) All costs and expenses of litigation recovered by any claimant against you in respect of a claim against you for compensation you are legally liable to pay.

Enhanced MaidAssure is a comprehensive insurance plan for your Foreign Domestic Worker (FDW) that covers the following benefits:- Accidental Death or Permanent Disablement,- Hospital & Surgical Expenses,- Replacement/Re-hiring Expenses,- Wages & Levy Reimbursement,- Repatriation Expenses,- Insurance bond guarantee.For more information, please refer to the policy wording. Alternatively, feel free to call us at +65 6206 5588, WhatsApp us at +65 8956 5588, or email us at customerservice@ecics.com.sg.

No, she is not covered unless she is travelling with you. We recommend purchasing a separate travel insurance for your FDW as the coverage would be more comprehensive for overseas situations where medical and evacuation costs are expected to be much higher.

To implement for MI policies, renewals or extensions with start date effective from:1 July 2023 (Stage 1)• Introduction of a co-payment element* for employers and insurers for amounts above $15,000, up to an annual claim limit of at least $60,0001 July 2025 (Stage 2)• Standardisation of allowable exclusion clauses• Introduction of age-differentiated premiums for those aged 50 and below, and those aged above 50• Requirement for insurers to reimburse hospitals directly upon the admissibility of the claimPlease visit MOM's website here for more information on the MI enhancements.

We accept payment via Visa/Master Retail Debit or Credit Card online.

Refund Policy (Upon Policy Termination):0 to 30 days in force – 80% refund of premium31 to 90 days in force – 50% refund of premium91 to 180 days in force – 30% refund of premium181 days and beyond – No refund100% of the premium will be refunded if:a) The Policy is cancelled within 90 days from the policy effective date and replaced with a new ECICS Enhanced MaidAssure policy; orb) The In-Principal Approval (IPA) is terminated and the FDW did not enter Singapore.Provided there shall be no refund if: • Any claim has been made or has arisen under the Policy; or • The premium refund is less than $27.25 (inclusive of GST). Please refer to General Conditions point 19 of the policy wording for the full cancellation terms and conditions.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We do not cover usage for food, parcel or other delivery services.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

All riders need to be named in the policy. Unnamed riders are not covered.

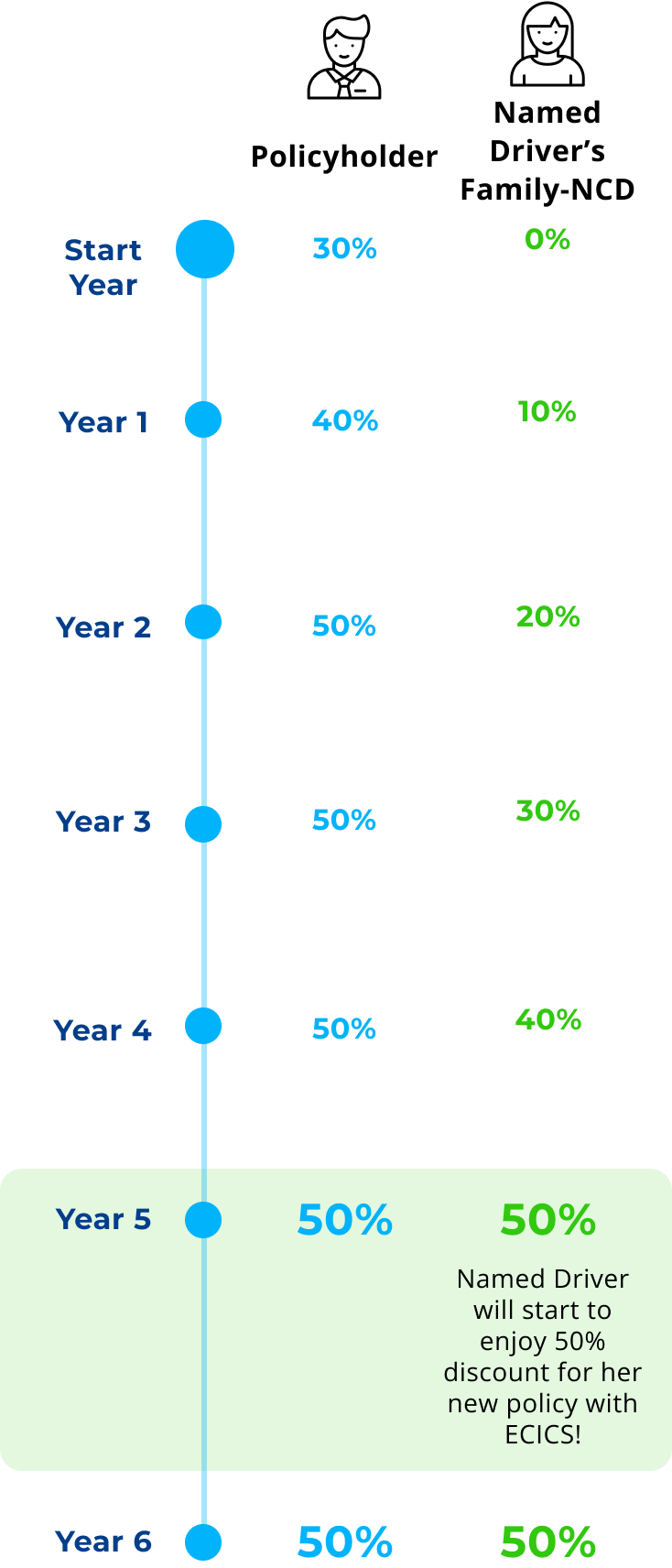

All earned Family-NCD will be reduced according to the GIA NCD framework (https://gia.org.sg/). However, with the Family NCD benefit still in place, it means all the Family NCD members can continue to earn 10% with each year of safe driving (max at 50%).

Report the accident to us within 24 hours or by the next working day and our representatives will help you with the accident reporting.

Yes, so long as the driver has a valid driving license and fulfils our underwriting criteria as named driver, you can purchase this plan and add them as a named driver in the Comprehensive Family NCD Builder Plan.

You should remember to take note on the following (if the traffic condition permits):Take photos and videos of the accident scene, surrounding areas, damaged property and the damages of the vehicles involved together with their license plate numbers.Exchange particulars with all drivers involved in the accident.Actual road name and any prominent landmarks.If possible, take down the particulars of all injured persons and note the extent of the injuries sustained.

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.