Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

Most insurers in Singapore will allow you to keep your NCD should there be a break in vehicle ownership for up to 24 months. Some insurers set the timeframe at 12 months. You should contact your insurer for details.

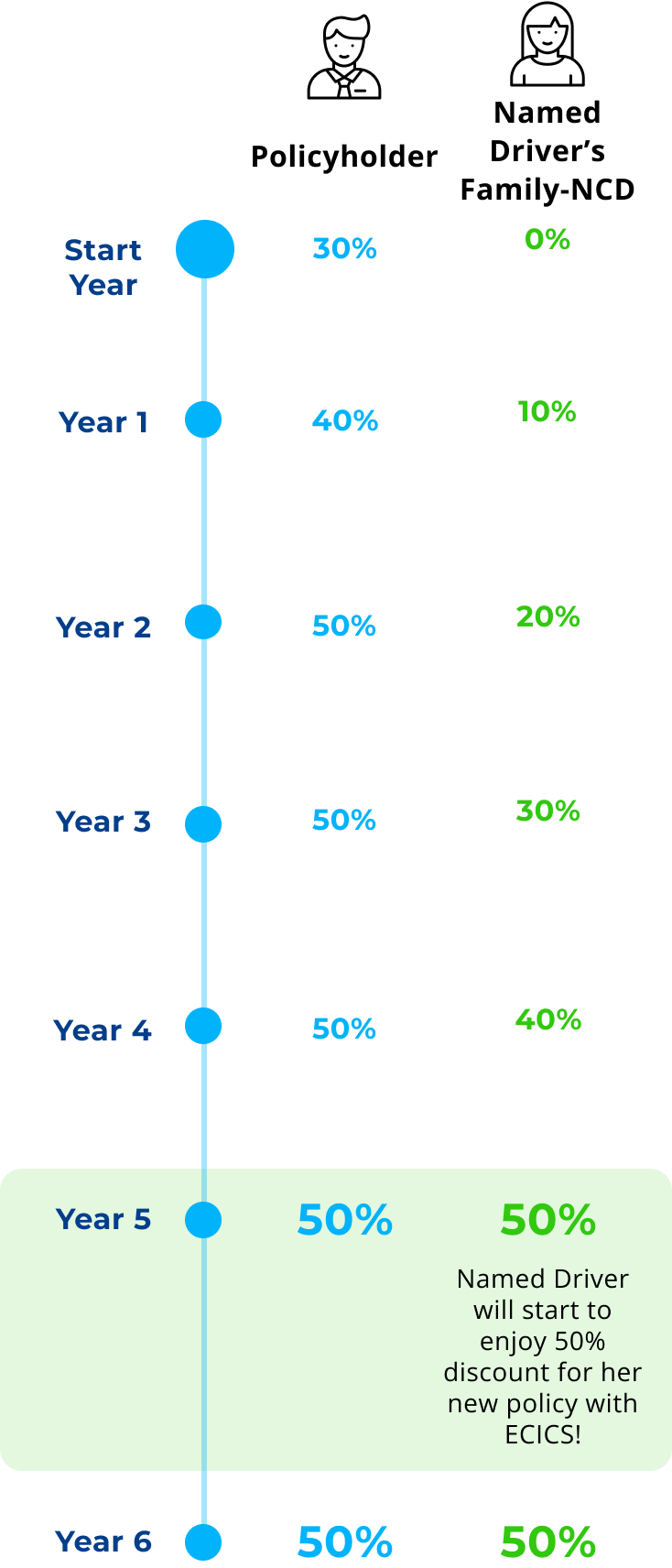

Just simply select our Comprehensive Family NCD Builder Plan during purchase and add your family members as named drivers.

Yes, you will qualify for this promotion when you renew your Tesla Motor Insurance, as long as no claims have been filed during the policy year.

The Insured Person must be: - a resident of Singapore who is permanently residing in Singapore; and - between 18 and 65 years old (both inclusive) at the time of application.

All Private Car, Commercial Vehicle or Private Hire drivers who own a valid motor insurance policy.

MOM will issue the discharge letter 1 week after the FDW has left Singapore. Please provide us with a copy of the discharge letter to proceed with your cancellation.Please note that the effective date of insurance cancellation will be determined based on the discharge date from MOM, not the date when the work permit is cancelled.

The eligibility criteria states that the insured FDW must be between 23 and 60 years old at the time of application. This means that individuals outside of this age range may not qualify for coverage under the insurance policy.

Certain amendments (e.g., typo error in name or passport number or change in effective date) can be made before the policy effective date. However, a re-transmission to MOM may be required depending on the type of amendment.

It is only covered under Hospital & Surgical Expenses if the FDW had been under your employment for more than 12 months.

Yes, we offer it as an optional add-on that covers outpatient medical expenses for illness that does not require hospitalisation. This benefit can cover up to $60 per visit, helping to ensure your FDW’s health needs are taken care of without added financial strain.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We do not cover usage for food, parcel or other delivery services.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

The moment the policy has lapsed/ceased, the Family NCD benefit will likewise cease. All earned Family-NCD will be forfeited. However, we understand that there could be various reasons why customers may temporarily not own a car therefore do consult us to see how we can help.

If there is a claim made under the policy, your NCD will be reduced as follows. Private Car Current NCD NCD after 1 Claim 50% 20% 40% 10% 30% and under 0% Motorcycle/Commercial Vehicle Current NCD NCD after 1 Claim 20%/15%/10% 0%

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

Proceed to any of our Approved Reporting Centres within 24 hours or by the next working day with a copy of the police report. We will proceed to process the Fire or Acts of Vandalism claims once investigation is completed. For Theft cases, as the police will need three months to complete their investigation therefore we will only pay out the claim after the investigation is completed.

A No-Claim Discount (‘NCD’) is an entitlement given to you if no claim has been made under your policy for a year or more with the current/existing insurer. It reduces the premium you have to pay for the following year. This is your insurer's way of recognising and rewarding you for having been a careful driver. There is a standard followed by all insurers in setting the NCD, depending on your type of vehicle (private, commercial or motorcycle) and the period of insurance with no claim. The following table shows how the NCD is set by all insurers across the industry. Private Car Period of insurance with no claim Discount on renewal 1 year 10% 2 years 20% 3 years 30% 4 years 40% 5 years or longer 50% Motorcycle/Commercial Vehicle Period of insurance with no claim Discount on renewal 1 year 10% 2 years 15% 3 years or longer 20%