Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

No, while its not compulsory, it’s strongly recommended to protect your business from legal and financial liability if someone is injured or property is damaged due to your operations.

ECICS Home Contents Insurance covers the personal belongings you own within the residential premises you’re renting. It also extends to cover your legal liability as a tenant for any loss or damage caused to the rented property.

No, there are no administrative or processing fees associated with claiming your Tesla Fractional Shares.

No, the benefits are non-transferable and will be credited to the Charge+ account linked to the insured vehicle.

Always select the higher risk occupation class if your job falls between two classes. This ensures you remain fully covered and avoids issues during claims assessment.

No, you do not need to pay $5,000 upfront to MOM as we act as a guarantor by issuing a Letter of Guarantee to MOM on your behalf. However, if you or your FDW breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. In such cases, we will seek recovery of the amount from you.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

We do not cover usage for food, parcel or other delivery services.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

All riders need to be named in the policy. Unnamed riders are not covered.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

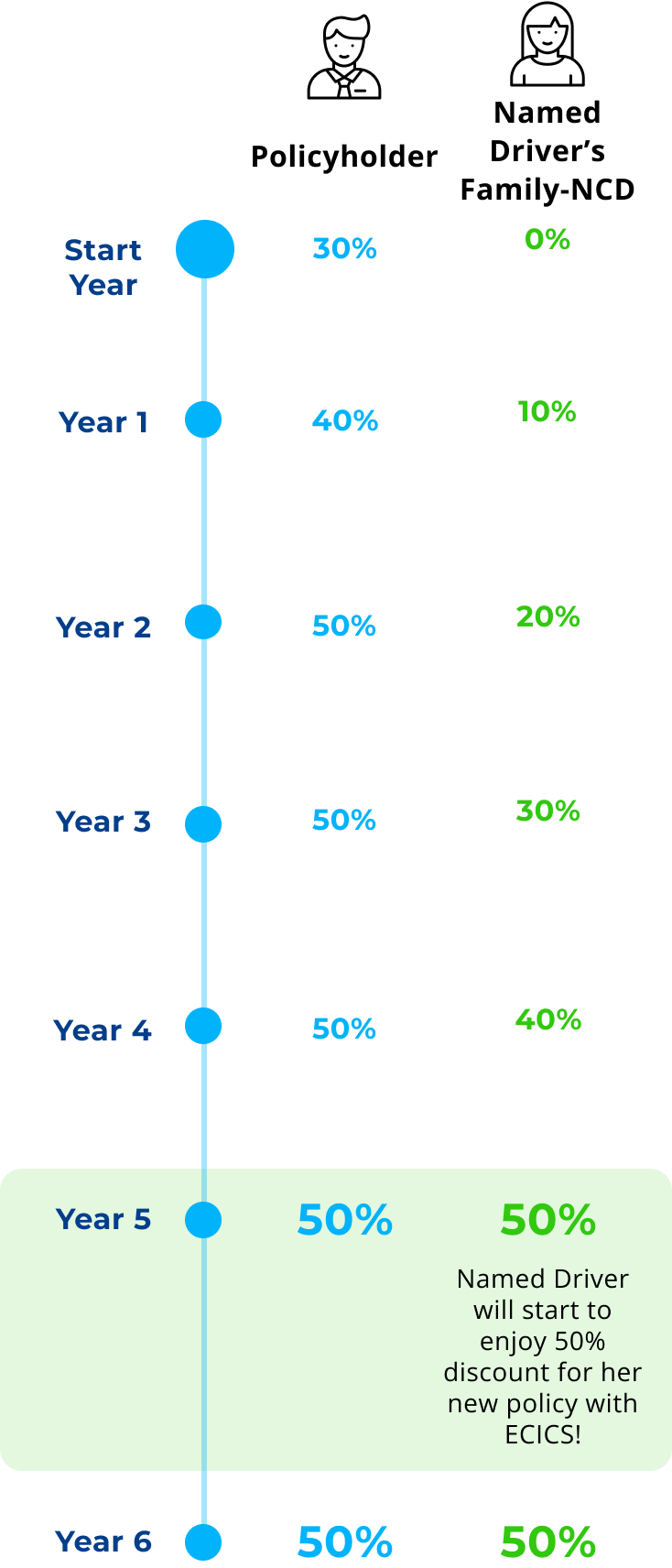

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

In the event that he utilise his earned Family-NCD to buy a new policy with us, he can still remain in the Family NCD policy as a named driver but he will not earn another Family-NCD. The Family-NCD can only be used once per policy per named driver.

The Family-NCD will not be affected as it follows the policy's claim experience. However, his past accident history will be taken into consideration when the Family NCD member get a new quote from us.

You are eligible for ECICS Private Motor Car insurance if: - you and your named drivers (if any) is/are the resident(s) of Singapore possessing a valid NRIC/FIN; - you are the main driver and owner of the Private Car; - you and your named drivers (if any) is/are not an existing ECICS’ Private Motor Car Policyholder with claims. - Neither you nor your named drivers (if any) has had his/her driving license (any class) suspended or cancelled in the last 3 years; - Neither you nor your named drivers (if any) has had his/her private car insurance refused, declined renewal or terminated by any insurers; - Your Private Car is or will be registered with the Land Transport Authority (“LTA”) and; - Your Private Car is not and will not be used for commercial purpose, hire and reward, rental or leasing.

Yes, You can let us know that the insured is not driving during the purchase by indicating the Main driver details separately which the policy is being underwritten on.