We’re Here To Help

Call us: +65 6206 5588

Email us: customerservice@ecics.com.sg

.png)

.png)

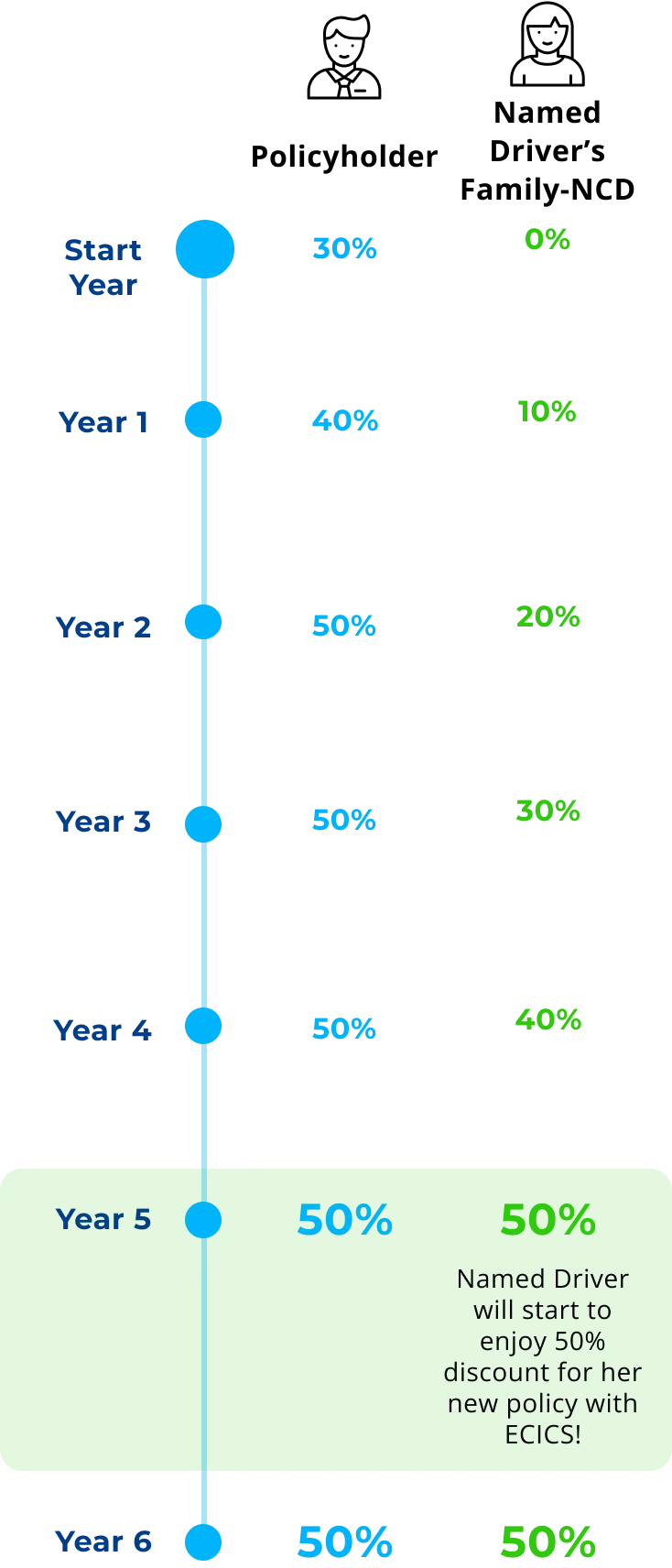

Every named driver earn 10% Family-NCD (up to 50%) for each year of safe driving as a family without any accidents - even if they don't own a car.

When your family member buys their own car, their accumulated Family-NCD can be used to reduce their insurance premium with ECICS.

Includes personal accident coverage up to $80,000 for your family members, child seat protection up to $300, and car key replacement cover up to $300.

Get 24/7 roadside assistance, and up to 10 days courtesy car while your vehicle is being repaired.

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

No, the benefits are non-transferable and will be credited to the Charge+ account linked to the insured vehicle.

If you purchase a new ECICS Comprehensive Private Car Insurance policy for a different vehicle not currently insured by ECICS, you are eligible for S$100 Shell Fuel e-Voucher for the new vehicle.

If you cancel your policy within 90 days, you’ll no longer be eligible for the Shell Fuel e-Vouchers.

For assistance, please contact us at +65 6206 5588 or email customerservice@ecics.com.sg. Our operating hours are Monday to Friday, 9:00 AM to 6:00 PM, excluding public holidays.

The Tesla Fractional Shares for this campaign will be processed and credited to the specified Policyholder's POEMS account within 3 to 4 months following the policy activation date (please note this is different from the purchase date of your policy).

If you cancel your policy, you will still keep your Tesla Fractional Shares. However, to be eligible for these shares, we advise you to maintain your policy for at least three months. This timeframe allows for the reconciliation process. Additionally, your policy must be active when the shares are credited to your POEMS account.

Tesla Fractional Shares for this campaign will be credited exclusively to the specified Policyholder's POEMS account.

Yes, provided you meet all the promotional terms and conditions, you will be eligible to claim them.

Yes, you must have a POEMS account under the Policyholder's name to be eligible for the campaign.

For questions about opening your POEMS account, please contact Phillip Securities' Customer Experience Unit at 6351 1555 or talktophilip@philip.com.sg.

No, the benefits are non-transferable and will be credited to the Charge+ account linked to the insured vehicle.

This benefit can’t be combined with other Charge+ charging offers, but it may be stacked with ECICS Insurance promotions if you meet the qualifying criteria. Do check our promotions page to find out more.

The promotional period lasts from 9th May 2025 to 31st December 2025 (both dates inclusive)

The Benefit shall be limited to one redemption per Qualifying Policy. Policyholders with multiple Qualifying Policies may be eligible for multiple redemptions.

This promotion applies to all private EV car insurance with ECICS. It excludes individual private hires and car fleets.

Shell Fuel e-Voucher can be used for fuel purchases at participating Shell service stations in Singapore. Locate your nearest Shell station here: https://www.shell.com.sg/shell-service-station/shell-station-locator.html

No, the voucher cannot be encashed.

For assistance, please contact us at +65 6206 5588 or email customerservice@ecics.com.sg. Our operating hours are Monday to Friday, 9:00 AM to 6:00 PM, excluding public holidays.

ECICS and Shell are not responsible if the voucher cannot be delivered due to an invalid or incorrect email address.

Yes, the promotion applies to purchases made directly or through an intermediary unless otherwise informed.